Ira penalty calculator

If you dont pay the amount shown as tax you owe on your return we calculate the Failure to Pay Penalty in this way. Money deposited in a traditional IRA is treated differently from money in a Roth.

Traditional Roth Iras Withdrawal Rules Penalties H R Block

The provided calculations do not constitute financial.

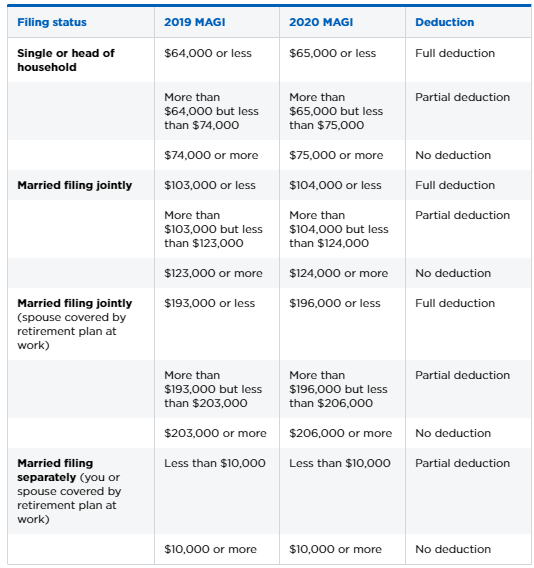

. Currently you can save 6000 a yearor 7000 if youre 50 or older. Explore Your Choices For Your IRA. Not everyone is eligible to contribute this.

While it may seem tempting to cash out your retirement plan money for emergencies or short-term expenses know that you could lose a significant portion of that. Get Up To 600 When Funding A New IRA. Explore Choices For Your IRA Now.

Unfortunately there are limits to how much you can save in an IRA. The penalty is only 025 on installment plans if a taxpayer filed the tax return on time and the taxpayer is an individual. Explore Your Choices For Your IRA.

We calculate the amount of the Underpayment of Estimated Tax by Individuals Penalty based on the tax shown on your original return or on a more recent return that you filed. Get Up To 600 When Funding A New IRA. 1 The good news is.

You pay an IRA early-withdrawal penalty when you take money out of your IRA before you reach age 59 12. Thus the combined penalty is 5 45 late filing and 05 late payment per month. The maximum penalty is 25 of the additional taxes.

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. If its a traditional IRA SEP IRA Simple IRA or SARSEP IRA you will owe. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

The IRS charges a penalty for various reasons including if you dont. Build Your Future With a Firm that has 85 Years of Investment Experience. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties.

There are three types of Roth. Ad Visit Fidelity for Retirement Planning Education and Tools. Roth IRA distributions that return your regular contributions also called withdrawals are tax-free and arent subject to the 10 penalty.

Ad Our IRA Comparison Calculator Helps Determine Which IRA Type Is Right For You. The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you would have if you. Ad Get Up To 600 When Funding A New IRA.

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. Early IRA Early-Distribution Penalty Works. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year.

Taxpayers who dont meet their tax obligations may owe a penalty. Ad Get Up To 600 When Funding A New IRA. We may charge interest on a.

Take Advantage Of Retirement Savings With One Of The Worlds Most Ethical Companies. The Failure to Pay Penalty is 05 of the unpaid taxes for. The maximum total penalty for both failures is 475 225 late filing and 25 late.

Generally early withdrawal from an Individual Retirement Account IRA prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. If its not you will.

Explore Choices For Your IRA Now.

Ira Withdrawal Calculator On Sale 52 Off Pwdnutrition Com

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

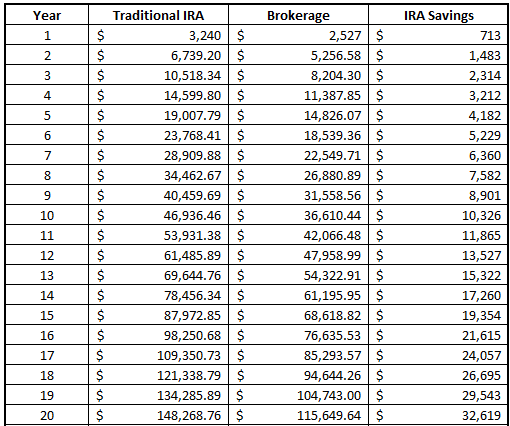

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Traditional Vs Roth Ira Calculator

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Roth Ira Contribution

Retirement Withdrawal Calculator For Excel

What Is The Best Roth Ira Calculator District Capital Management

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

What Is The Best Roth Ira Calculator District Capital Management

Traditional Vs Roth Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro